The Fed is sending up a flare: the economy may be softening.

In a recent speech, Federal Reserve Chair Jerome Powell signaled that interest rate cuts could be on the table soon.

He expressed rising concern about the job market, noting a sharp slowdown in hiring and the risk of further weakness ahead.

And he’s not alone. Other indicators have started pointing in the same direction.

Taken together, these signals point to potential shifts in economic momentum that could affect interest rates, the markets, and your financial plan.

Let’s start with what has the Fed most concerned: jobs.

In his speech, Powell highlighted several worrying trends in the labor market. Over the past three months, employers have added an average of just 35,000 jobs per month. That’s a steep drop from the 168,000 monthly average we saw in 2024.1

Long-term unemployment is rising too. Nearly 1.8 million Americans have been out of work for more than 27 weeks, up 20% from a year ago.2

In his words, “the stability of the unemployment rate allows us to proceed carefully,” but the recent data may “warrant adjusting our policy stance.”3

Translation: interest rate cuts are on the table.

But it’s not just the Fed chair who’s raising concerns about the economy. Other reports have started to echo that same message.

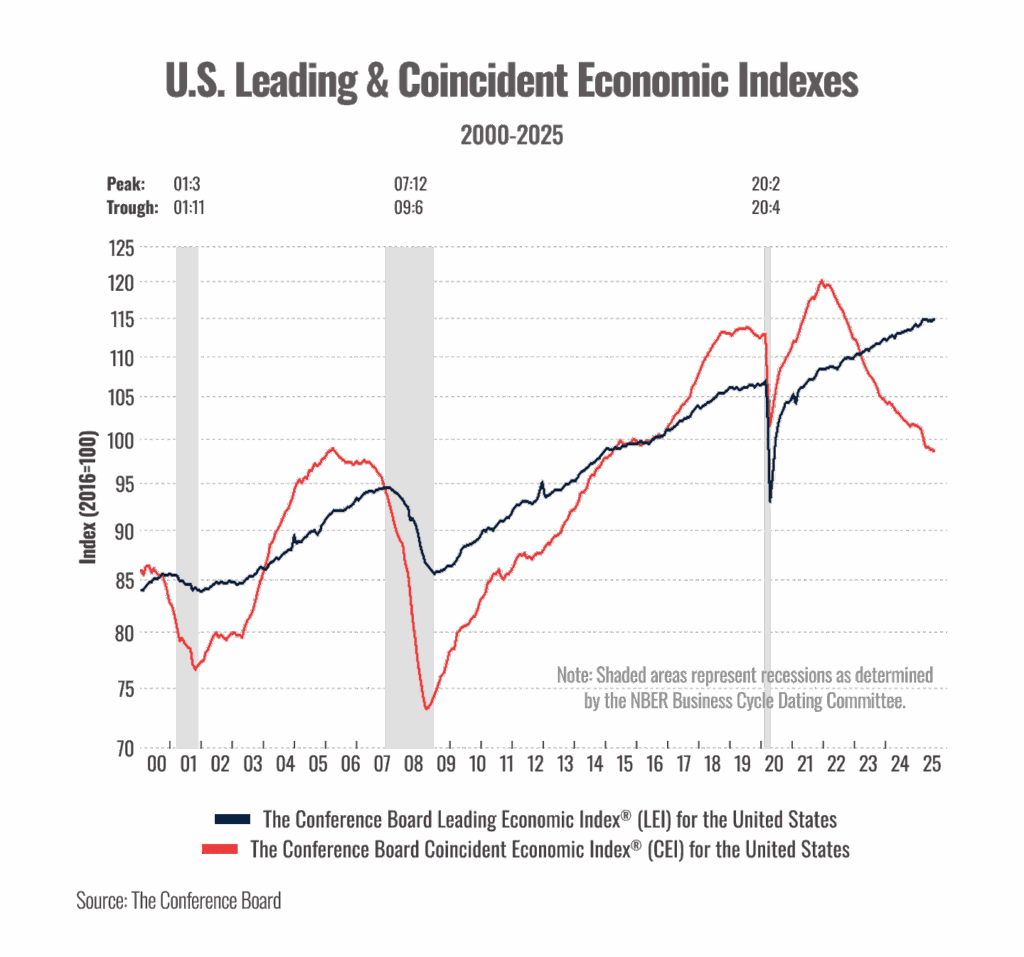

One of the most telling is the Conference Board’s Leading Economic Index, or LEI.

Think of the LEI like an early warning indicator on your car’s dashboard. It pulls together a range of forward-looking signals from across the economy like manufacturing orders, building permits, jobless claims, and consumer sentiment.

No single indicator tells the whole story. But when multiple indicators start showing similar warning signs, it’s worth paying attention.

In July, the LEI declined for the sixth month in a row.4

The chart below shows how sharp LEI declines like this have correlated with recessions over the past two decades.

So, what does this all mean?

For the economy, it suggests a shift toward slower growth (and possibly a mild recession) is becoming more likely. If that happens, the Fed may cut rates to help cushion the impact, making it cheaper to borrow and invest. But it’s also a sign that economic momentum is softening, which can affect businesses and workers alike.

For your personal finances, lower interest rates could reduce borrowing costs on things like mortgages, credit cards, or car loans. At the same time, savings accounts and other interest-based products may see lower yields. Managing cash flow and debt wisely becomes even more important in an environment like this.

For your investments, things can feel a bit counterintuitive. A slowing economy (which often triggers rate cuts) can sometimes be good for both stocks and bonds. Why? Because lower interest rates reduce borrowing costs, which can boost corporate profits and investor appetite, especially in sectors like real estate and technology. Bonds may also benefit as yields fall and existing bond prices rise. That’s why the S&P 500 closed at record high last week.5

While none of this calls for immediate action, it does call for attention.

A well-structured financial plan can help navigate market shifts like these.

But if anything in your life has changed (or if you just want to stress test your strategy), we’re here to talk.

__

Sources:

Chart Source:

The Conference Board, 2025 [URL: https://www.conference-board.

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Advisory services offered through Wilon Wealth Management, a Registered Investment Adviser Firm.