Politicians are creating more drama than Hollywood over the federal debt ceiling.

Let’s recap what we know with some educated speculation about what could happen next.

What is the debt ceiling and why is it in the headlines (again)?

The federal debt ceiling is a limit on how much the U.S. Treasury can borrow to pay government commitments already approved by Congress.1

Once the ceiling is reached, Congress must either increase or suspend it so the Treasury can issue new debt and raise the money needed to cover its bills.

Once an ordinary part of federal accounting, adjusting the debt ceiling is now a political negotiation, threatening the Treasury Department’s ability to pay its bills next month.

Though it’s unlikely either party will allow the U.S. to default on its obligations, this political brinkmanship adds anxiety each time it comes up.

What would happen if Washington doesn’t reach a resolution?

Treasury Secretary Janet Yellen has warned that the U.S. could run out of money by June 1 if Congress doesn’t act.1

While so-called “extraordinary measures” are being used to extend the timeline, if neither side budges, the U.S. could officially default on its sovereign debt for the first time in history.

Even if Congress quickly reversed course, a temporary default could still trigger a market correction and agitate credit markets.

Given how fragile the collective American psyche is about the economy right now, a default could trigger a recession or major job losses as businesses pull back on spending.

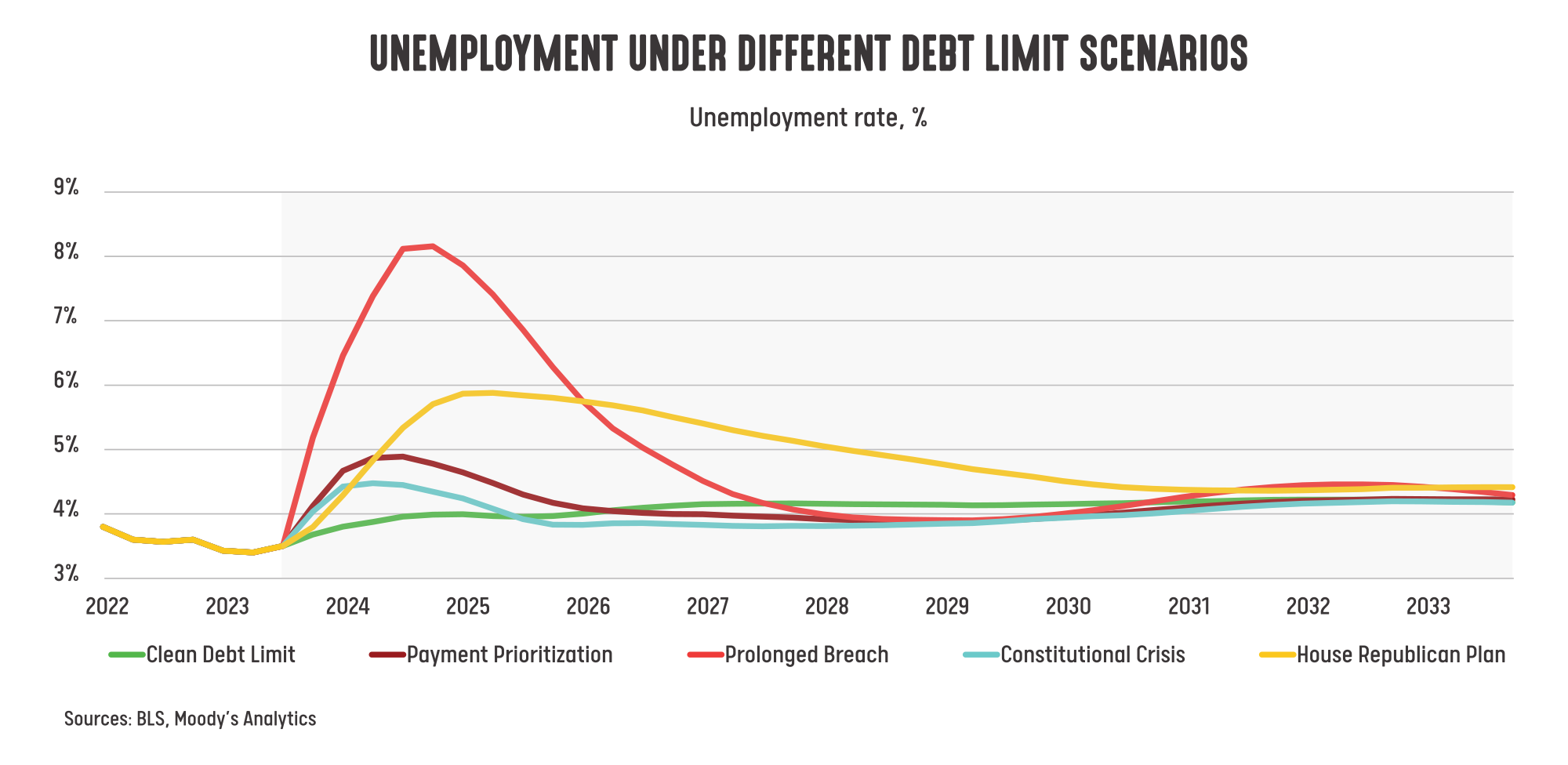

The chart below projects unemployment across multiple potential default scenarios that are being discussed.2

You can see that most of them could result in a spike in unemployment as a default ripples through the economy.

Bottom line: A debt default could be very bad news for global markets and the U.S. economy.

Here’s the potential good news: It doesn’t seem likely that either political party will allow the U.S. to default on its debts.

The price of an impasse is too high; however, it could happen, so let’s be prepared for that eventuality.

What can we do about the debt ceiling showdown?

Not much.

As investors, we’re along for the ride. However, the aim of our diversified portfolios is to make this ride less volatile.

Read This Perspective from our partner at Lord Abbett if you’d like to read more about the U.S. debt ceiling debate and what’s at stack for investors.

In the meantime, we’re closely monitoring the situation and meeting regularly as a team to discuss different scenarios. If any changes to your strategies are warranted, we’ll update you accordingly.

Until then, deep breath. We’ll get through this.

__

Sources

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Advisory services offered through Wilon Wealth Management, a Registered Investment Adviser Firm.