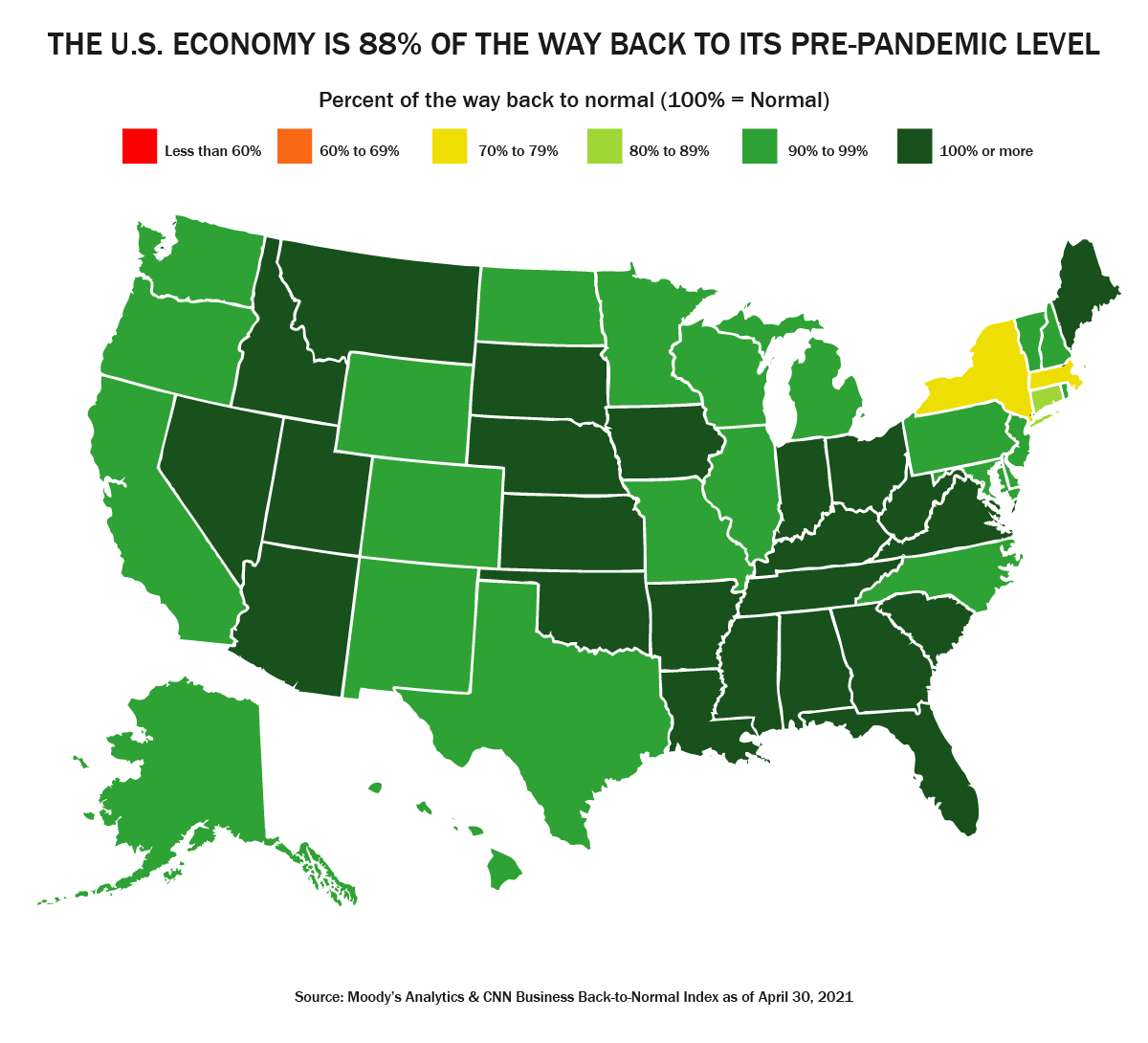

Two things to discuss today: the economy (getting better) and taxes (going up?).

Let’s dive in.

The light at the end of the tunnel is getting closer and brighter.

After over a year of uncertainty and dread, the future is looking up.

Things aren’t completely rosy, of course.

Major COVID-19 surges in India and Brazil mean millions are still suffering.4

Viral variants mean the pandemic may not be “over” for a long time and we still need to be careful not to undo all our gains.

Many folks are not experiencing the economic recovery and may need years to recover what they have lost.

However, let’s not let the work ahead take away from the progress we’ve made.

Let’s take a deep breath and appreciate how far we’ve come since March 2020.

… Deep Breath …

Now, let’s talk about taxes.

President Biden just unveiled a plan to increase taxes on high earners to pay for economic reforms as part of the American Families Plan.5

What’s on the table is likely to change as political wrangling continues, but here are a few things we’ve got to consider so far:

A higher top income tax rate of 39.6% (though it’s not clear yet who falls into that top tax bracket).

Raising the top tax rate on long-term capital gains to 39.6%. With the 3.8% Medicare surtax, that means the highest earners could pay a 43.4% rate on gains.

The elimination of the step-up basis for estates, meaning heirs could get stuck paying taxes on capital gains over $1 million (even if nothing has been sold) when they inherit.

This change could impact folks who, for example, inherit family homes that have appreciated in value. They might want to keep the home, but may not be able to afford the tax bill.

So, should I be worried?

Alert and informed, definitely. Anxious and worried, no.

Here’s why:

This is a proposal. It’s got a long way to go before becoming law and the details may change.

It’s still unclear how much impact these proposed changes will actually have. There are many advanced strategies that can help mitigate the impact of higher taxes. That’s why tax and estate strategies matter so much.

A study done by Wharton Business School suggests that tax mitigation strategies could help avoid 90% of the proposed tax increases on capital gains.6

Bottom line, the proposed changes are concerning, especially with so many details left to be determined, but it’s not time to panic.

Be well and let us know if you have questions we can help answer.

Chart source: https://www.cnn.com/business/us-economic-recovery-coronavirus (As of April 30, 2021)

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Advisory services offered through Wilon Wealth Management, a Registered Investment Adviser Firm.